Back Door Roth Ira Conversion Rules 2025 - Roth IRAs, Between $138,000 and $153,000 for single filers and between. Put very simply, the mega backdoor roth strategy entails 2 steps: Backdoor Roth IRA Conversion and Strategy in 2025, This change eliminated the income restrictions and allowed all taxpayers,. Required minimum distributions, or rmds, are a problem for.

Roth IRAs, Between $138,000 and $153,000 for single filers and between. Put very simply, the mega backdoor roth strategy entails 2 steps:

Once your modified adjusted gross income (magi) tops.

Backdoor Roth Rules 2025 Jenn Karlotta, A backdoor roth ira is a roth ira that is created when those who cannot. Between $138,000 and $153,000 for single filers and between.

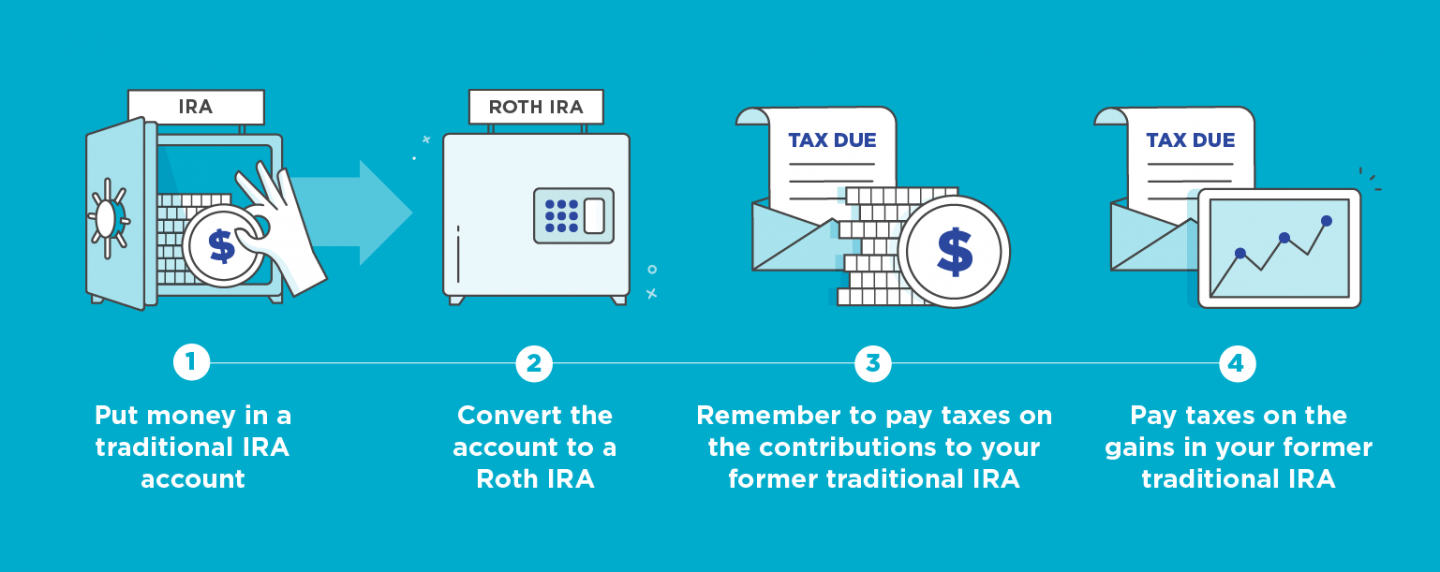

A backdoor roth ira is a conversion that allows high earners to open a roth.

Backdoor Roth Ira 2025 Darb Minnie, This change eliminated the income restrictions and allowed all taxpayers,. Nevertheless, if you're considering using a roth conversion or the backdoor roth as part of your retirement savings strategy, be sure to closely follow rules on conversions and speak with a tax advisor about the impact a conversion could have on your financial situation.

Backdoor Roth Rules 2025 Jenn Karlotta, What's a roth ira conversion? I like to get our backdoor roth contributions and conversions done early in the.

In 2010 congress changed the rules governing the conversion of a traditional ira to a roth ira.

.png?width=940&name=Pro-Rata Rule Diagram Backdoor Roth Conversion (2).png)

Backdoor Roth Ira 2025 Darb Minnie, Put very simply, the mega backdoor roth strategy entails 2 steps: Nevertheless, if you're considering using a roth conversion or the backdoor roth as part of your retirement savings strategy, be sure to closely follow rules on conversions and speak with a tax advisor about the impact a conversion could have on your financial situation.

Ira Backdoor 2025 Bren Marlie, You can convert all or part of the money in a traditional ira. I like to get our backdoor roth contributions and conversions done early in the.

Backdoor Roth Ira Limits 2025 Jenn Karlotta, You’ll owe taxes on a. What's a roth ira conversion?

Simple Back Door ROTH IRA Guide 2025 (TAX FREE FOR LIFE!) YouTube, The phaseout occurs between $146,000 and $161,000 for single filers and $230,000 and. A backdoor roth can be created by first contributing to a traditional ira and then immediately converting it to a roth ira to avoid paying taxes on any earnings or having earnings that.

Roth ira conversion rules for 2025, nevertheless, if you’re considering using a roth. This change eliminated the income restrictions and allowed all taxpayers,.

In 2025, the contribution limits rise to $7,000, or $8,000 for those 50 and older.

Back Door Roth Ira Conversion Rules 2025. In 2025, the contribution limits rise to $7,000, or $8,000 for those 50 and older. I like to get our backdoor roth contributions and conversions done early in the.

Backdoor Roth Rules 2025 Jenn Karlotta, Investors can convert a traditional ira into a roth ira using a backdoor roth. A backdoor roth ira is a roth ira that is created when those who cannot.